Over $11 Million in Recoveries Despite Only $25,000 in Insurance

The rear end crash left John Doe a quadriplegic totally dependent on others for everything. The accident also transformed Jane Doe's life because she had to quit her job to take care of John 24 hours a day. Because John was on the job when it all happened, John and Jane do receive the minimal benefits provided by worker's compensation, but John's catastrophic injury and the loss of both their jobs left them destitute and desperate.

The rear end crash left John Doe a quadriplegic totally dependent on others for everything. The accident also transformed Jane Doe's life because she had to quit her job to take care of John 24 hours a day. Because John was on the job when it all happened, John and Jane do receive the minimal benefits provided by worker's compensation, but John's catastrophic injury and the loss of both their jobs left them destitute and desperate.

The 88-year-old driver who crashed into John's pickup only had $25,000 in insurance. When the insurance company started nitpicking Jane, her sister put her in touch with Pajcic & Pajcic. Through a combination of three different lawsuits over the past four years, Pajcic & Pajcic was able to recover in excess of $11 million for the Does.

The first lawsuit resulted in a significant recovery from the other driver's insurance company because of its bad faith conduct in handling Jane's claim. The second, a medical malpractice lawsuit, provided a modest recovery.

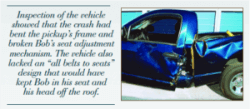

The final lawsuit was a products liability action against the manufacturer of John's pickup.

Inspection of the vehicle showed that the crash had bent the pickup's frame and broken John's seat adjustment mechanism. The vehicle also lacked an "all belts to seats" design that would have kept John in his seat and his head off the roof.

Experts hired by Pajcic & Pajcic testified that these defects made the pickup uncrashworthy and caused John's injuries. The case resolved at mediation.

The greatest reward for Pajcic & Pajcic is seeing the transformative effect a substantial recovery can have on the families of catastrophically injured clients.

John and Jane have built a new house that has all the latest handicap accessories, including lifts for the pool, the bathroom and the bed.

Of course, they would trade it all to have John's body back the way it was.